War and Peace

"Trade wars are good, and easy to win," says Trump.

The US Trade War against China

Decades in the Making by Trump and Navarro

1980's to 2006Trump: "Exports are good, imports are bad"

"Donald J. Trump’s blistering critique of American trade policy boils down to a simple equation: Foreigners are “killing us on trade” because Americans spend much more on imports than the rest of the world spends on American exports,"according to the New York Times

on 10 March, 2016.

It seems that Trump's "exports are good, imports are bad" phlosophy stems from his largely mercantilist nature of his property business, where he would seek to maximise his cash income for any property he had built. Trump’s mercantilism is among his oldest and steadiest public positions. Since at least the 1980's, he has described international trade as a zero-sum game in which countries lose by paying for imports.

Most people today do not even know what a mercantilist

is because Adam Smith totally destroyed mercantilism when he wrote The Wealth of Nations, arguing that the real wealth of the nation is our ability to produce goods, i.e. what we call gross domestic product, rather than how much gold or silver or other assets we have. In particular, he explained how England, which had very little gold, was so much richer and powerful than Spain, which virtually controlled the world’s gold supply at the time.

A mercantilist focuses on maximising the country's money hoard rather than its prosperity (its material well-being), much like a dragon who sits on a hoard of gold. When Trump talked about how foreign countries were "ripping off" the United States on trade, he was talking about how money (and debt instruments, which are claims on money) were flowing into those countries from the US.

In 2000, Trump toyed with a run for president and wrote a campaign book, The America We Deserve, which called China the U.S.'s "biggest long-term challenge" before China even joined the WTO in 2001, and could be considered the embryo of his "America First" ideology today.

Thus, Trump wanted to take us back to the dark age of economics, from which only the wealthy would benefit in the end.

"Trump’s exports-good, imports-bad trade policy, debunked by an economist", The Conversation, 20 April, 2018

"Trump essentially subscribes to a modern version of mercantilism, a school of thought most economists believe Adam Smith extinguished after he published his landmark book “The Wealth of Nations” in 1776. Mercantilism rests on a key idea: Exports are good and imports are bad. People who believe in mercantilism therefore see global trade as a zero-sum game.

Like nearly all economists, I believe that contemporary mercantilism is wrong on three counts. First, trade is not a zero-sum game. Second, imposing new and higher tariffs on imports won’t make the U.S. trade deficit go away. Third, reciprocity in trade negotiations does not require all countries to cut their tariffs to the same level.

Actually, every one of my students at The Ohio State University can explain why trade is a positive-sum game. Most of the exchanges that occur, such as when the U.S. sells China soybeans and China sells the U.S. sneakers, are efficient uses of a country’s resources. Overall, trade boosts national incomes and consumer purchasing power.

Due to low household savings and high federal expenditures, the U.S. runs a trade deficit, imports making up the difference between consumption and production.

Given this macroeconomic imbalance, raising tariffs and pulling out of trade deals will not tame the trade deficit. Any reduction in imports from, say, China, would be matched by new imports from elsewhere. A more effective policy would encourage U.S. households and businesses to consume less and save more while cutting federal spending..."

2006 to 2016Navarro: China is "on a collision course with the entire world."

"China's breakneck industrialisation is placing it on a collisions course with the entire world. Tomorrow's China Wars will be fought over everything from decent jobs, liveable wages, and the leading-edge technologies to strategic resources such as oil, copper, and steel ... even food, water, and air."

Thus begins the blurb of Navarro's 2006 book

The Coming China Wars. In fact, you know you are in for some catastrophic scenarios when you read the author's prediction in the form of a "News Release, October 25, 2012" on the first page of the Introduction:

- "Global stock exchanges were devastated this week by the worst collapse in history as a wave of panic selling followed...a Chinese government announcement that it would no longer finance the mounting budget and trade deficits of a 'profligate United States'."

- "Meanwhile, domestic unrest in China continues to escalate... A recent report released by the US Central Intelligence Agency has warned that should such domestic unrest reach a boiling point in China, the result may be 'sharper military conflicts with the United States, Taiwan, and possibly even Japan as Chinese leaders seek to unify the now increasingly fractured nation against a 'common enemy.'"

On the surface, messages such as the above seem to make some logical sense. Yet, by making extensive use of distorted, biased as well as bad information about China available on the internet (Author's note for The Coming China Wars: "Much of the research conducted for this book was done over the internet."), it is clear that Navarro has deliberately painted a "China catastrophe" picture, aimed at capitalising on Americans' "fear" of that catastrophe for a distinct political edge.

He developed this fear even further in his 2011 book Death by China,

which says you buy anything made in China at your own peril, and his 2015 book Crouching Tiger, which explores the fear associated with the question "Will there be war with China?" To popularise his books, he also produced documentary films with the same title.

While teaching economics and public policy at UC Irvine, Navarro's antagonism toward China was pervasive, and it seeped into the classroom and around the business school. He even had his 2012 documentary screened on campus, and offered his undergraduate students 5 percent extra credit if they attended.

Trump was also a big fan of Death By China, Navarro’s 2012 documentary. In fact, his praise for the film graces the top of the documentary’s official website: “DEATH BY CHINA is right on. This important documentary depicts our problem with China with facts, figures and insight. I urge you to see it.”

According to Navarro, he and Trump first came into contact in 2011 when he read that Trump had listed his book The Coming China Wars

among his top 20 favourite books on China out of “hundreds” he had read in an interview. "I know the Chinese. I've made a lot of money with the Chinese. I understand the Chinese mind," Trump said in the same 2011 interview.

Yet, according to the investigation of Loren Collins, an Atlanta attorney, it is complete fiction that Trump has read "hundreds of" books on China. In his article "Debunking Donald Trump’s ‘20 Favorite Books on China" published at

Medium.com, he reports that according to Archive.org, the site was first edited to add that quote not in 2011 or 2012, but sometime between March 7 and March 29, 2016, mere days before Navarro publicly praised and endorsed Trump’s candidacy.

His conclusion is that both Navarro and Trump had used a story they knew to be fake to further their interests. This is of course consistent with the following words of Politico.com:

“They’re two peas in the pod, I’m telling you,” said Beckie Mann, who managed Navarro’s mayoral campaign and the start of a subsequent bid for city council. “He and Trump, you could interchange their names. … I think they’re just scoundrels, myself."

"Trump's top China expert isn't a China expert," Foreign Policy, 13 March, 2017

"The China that [Navarro] describes in Death by China bears only a tangential relationship to the China that I lived in for a decade."

- Patrick Chovanec, chief strategist at Silvercrest Assest Management

"Navarro's books and his documentary have close to zero credibility with people who know the country," and are filled with "hyperbole, inaccuracies" and a cartoonish caricature of China that he puts out."

- James McGregor, former chairman of the American Chamber of Commerce in China, who lived in Beijing for fifteen years

"I read Trump's trade adviser's anti-China book. It’s wilder than you can imagine," Vox, 6 April, 2017

Zeeshan Aleem

Foreign affairs staff writer, Vox.com

Peter Navarro doesn’t want you to buy toys that were made in China, because he believes they’ll poison your children. He doesn’t want you to buy pyjamas sewn in China, because he thinks they could catch on fire. He doesn’t want you to buy phones that were assembled in China, because he believes they could explode and kill you. In fact, he doesn’t want you to buy anything at all from China, because he thinks every dollar the country receives will be spent on trying to destroy the US. ...

Navarro possesses a striking blend of animosity and paranoia about anything have to do with China. In Death by China, which he deems his “survival guide” to outmanoeuvring “the planet’s most efficient assassin,” he warns the reader against ever purchasing Chinese products.

“Unscrupulous Chinese entrepreneurs are flooding world markets with a range of bone-crushing, cancer-causing, flammable, poisonous, and otherwise lethal products, foods, and drugs,” he warns.

At one point, Navarro asks the reader to engage in a cautionary thought experiment and — using a military phrase popularised during the Vietnam War — imagine that “your best friend is ‘fragged’ when the [Chinese-made] cell phone in his chest pocket explodes and sends bone shrapnel into his heart.”

In short, Navarro is consumed by an existential fear of all things Chinese.

"Peter Navarro: Trump’s Nutty Economics Professor" National Review, 14 April, 2017

Kevin D. Williamson

The roving correspondent, National Review

"His fearful books and risible policy analyses are not written for the Dan Ikensons of the world, or even for those freshman econ students who could spot the errors in his work. They are written for partisans and true believers. This is a very large audience - Sean Hannity's audience. ... Navarro's China books are also written to stir emotion, not light."

"Navarro's trade views 'misguided', 'dangerous'" The Hill, 23 December, 2016

Dan Ikenson

Director of Cato’s Herbert A. Stiefel Center for Trade Policy Studies

"Navarro’s misguided views of trade as a win-or-lose proposition and trade policy as an adjunct of warfare represent a dramatic departure from the bipartisan, pro-trade consensus that has guided U.S. policy since the end of World War II...

To Navarro, trade isn’t cooperation, but a winner-take-all competition. Trade is a battle between Team America and Team China (or whoever the foreign nemesis may be).

Tariffs on imported Chinese steel, for example, may benefit U.S. steel producers in the short run, but it hurts far more producers in industries that use steel in their own production, and the costs ripple throughout the economy.

The economic illiteracy that animates Navarro’s policy prescriptions is startling...

Imports have nothing to do with GDP – other than the fact that they increase when the economy is growing and they tend to decrease when the economy is contracting... There is no inverse relationship between imports and GDP, as Navarro asserts."

2016 Presidential CampaignTrump: China has "raped" America on trade

On 16 June, 2015 in Manhattan, Trump made his presidential campaign announcement speech, which began with the following line:

"Our country is in serious trouble. We don’t have victories anymore. We used to have victories, but we don’t have them. When was the last time anybody saw us beating, let’s say, China in a trade deal? They kill us. I beat China all the time. All the time."

He then went on to claim that he would be“the greatest jobs president that God ever made”. He told the crowd not to believe government statistics showing unemployment had fallen to 5.4%. “Our real unemployment is 18-20%, don’t believe their 5.6% [in fact the official figure is 5.4%]. China has our jobs, Mexico has our jobs. I’ll bring back our jobs and bring back our money.” In total, Trump mentioned "China" 25 times in the speech.

Throughout the campaign, Trump loved talking about China, culminating in stating during a campaign rally in Fort Wayne, Ind. on 2 May, 2016 that:

"We can’t continue to allow China to rape our country and that’s what they’re doing. It’s the greatest theft in the history of the world.”

Along with "jobs lost", Trump cited the US-China trade deficit, which stood at $347 billion in 2016, as proof that the US is “losing” to China at trade - as if, as most economics laymen would understand it, China has obtained something from the US without paying for it.

Sounds absurd - and it is (see professional analysis by expert economists on the right).

But to back up Trump's rhetoric, University of California-Irvine professor Peter Navarro and billionaire investor Wilbur Ross – both of whom were officially named to Trump's economic advisory team in early August - wrote and published a White Paper on Trump's economic plan on 29 September, 2016.

The paper says Trump will eliminate America's multi-billion dollar trade deficit "through a combination of increased exports and reduced imports." There's little indication how Trump uniquely will be able to raise demand for American goods abroad, particularly if his administration begins making waves with major buyers of American goods – like Canada, Mexico, Europe and China.

In fact, as specifically analysed by expert economists on the right, Trump's economic plan has so little credibility that a group of 370 economists, including eight Nobel laureates in economics, have signed a

letter

warning against the election of Republican nominee Donald Trump, calling him a “dangerous, destructive choice” for the country.

Signatories include economists Angus Deaton of Princeton University, who won the economics Nobel last year, and Oliver Hart of Harvard University, who was one of the two Nobel winners this year.

The letter is notable because it is less partisan or ideological than such quadrennial exercises, and instead takes issue with Mr. Trump’s history of promoting debunked falsehoods.

“He misinforms the electorate, degrades trust in public institutions with conspiracy theories and promotes willful delusion over engagement with reality,” said the signatories, which also include Paul Romer, the new chief economist at the World Bank, and Kenneth Arrow, the 1972 Nobel winner.

The economists object to Mr. Trump for questioning the legitimacy of economic data produced by institutions such as the Bureau of Labour Statistics - remember his rhetoric on job losses earlier! They also chide Trump for failing to “listen to credible experts” and for promoting “magical thinking and conspiracy theories over sober assessments of feasible economic policy options,” and say that he has promoted "misleading claims about trade."

Yet, Trump eventually won the election after successfully promoting the idea that America is under threat and that he is the strongman leader in face of this threat.

The threat of migrants from neighbouring countries like Mexico aside, Trump's projection of the economic threat from China and how he would beat China if elected has played a crucial role in helping him win the election, as analysed by David Autor, a leading empirical economist at MIT.

Professor Autor's work on how a large number of American jobs have been lost in certain labour-intensive sectors, like shoes, textiles, dolls, and commodity furniture, as a result of China's economic development, dubbed "the China Shock", has gained a lot of attention.

However, "the China Shock" has to be placed in context. (See below for further analysis of the myth of American jobs' loss to China.)

Even then, we find below Professor Autor's response when interviewed by Zeeshan Aleem from

Vox in March 2017 about Trump's economic plan:

Zeeshan Aleem: "What do you think about Trump’s trade vision, which blends closing ourselves off from the world to some degree with scaling down trade commitments?"

David Autor: "It's extremely naive and uninformed. I don't think it has any basis in economic reasoning about the costs and benefits of trade. I think he is a pure mercantilist — he simply thinks exports are good, imports are bad.

I think the idea of slapping large tariffs, or border taxes, on imports is a very destructive idea on all kinds of fronts."

International trade attorney Scott Lincicome analyzes attacks on free trade

"Almost Everything Donald Trump Says About Trade With China Is Wrong", The Federalist, 20 January, 2016

Scott Lincicome

An international trade attorney, adjunct scholar at the Cato Institute and Visiting Lecturer at Duke University.

"[T]he idea that the U.S.-China trade balance proves that we’re “losing” at trade is the height of economic ignorance. For one thing, there’s actually a strong correlation between U.S. economic growth and an expanding U.S. trade deficit.

"It’s highly unlikely the Trump tariff would lead to a significant increase in U.S. manufacturing. Sure, a few directly competitive U.S. companies might benefit from that sweet, sweet import protection (by being able to milk U.S. consumers for more money), but the far more likely result is trade diversion—i.e., imports would shift from China to other (more expensive) foreign countries like Vietnam, India, or Mexico.

"Trump’s tariff plan is both immoral and un-conservative. Tariffs are regressive taxes that harm poor Americans far more than wealthy folks like Trump because they force the former to pay a bigger share of their (much smaller) paychecks for basic necessities like food, clothing, and shelter."

"Donald Trump Is Wrong On China - Again", Forbes, 2 May, 2016

Tim Worstall

Fellow at the Adam Smith Institute in London

"Donald Trump's claim that China is raping America is simply absurd and the claim must be treated as the nonsense that it is. China happens to be producing things that American consumers desire to have--nothing like the vile and foul crime of rape. ...

"We are not being attacked, raped or made poorer in any manner by buying more goods from China than we sell to them. Quite the contrary: We are made richer by what we import.

"Yes, it's true, imports are recorded as a subtraction from GDP, exports as an addition to them. But this is simply a trick of national accounting, not a reflection of the underlying economic reality. Both Adam Smith and Frederic Bastiat tell us that the purpose of an economy is consumption.

"What we get to eat, wear, play with, travel in is what determines how rich we are. Not how much we produce at all, but how much we can consume. Imports are an addition to what we can consume thus they make us richer."

"Donald Trump’s experts are basing his trade policy on a remarkably silly mistake", Vox.com, 29 September, 2016

Matthew Yglesias

Senior Correspondent at Vox.com

“When net exports are negative,” Ross and Navarro write, “that is, when a country runs a trade deficit by importing more than it exports, this subtracts from growth.” They believe that, therefore, we can boost growth by curtailing imports, as explicitly stated in their White Paper:

"Trump proposes eliminating America’s $500 billion trade deficit through a combination of increased exports and reduced imports. Again assuming labor is 44 percent of GDP, eliminating the deficit would result in $220 billion of additional wages. This additional wage income would be taxed at an effective rate of 28 percent (including trust taxes), yielding additional tax revenues of $61.6 billion."

"Here’s a quick way to tell that something has gone wrong with the Ross/Navarro argument. Last year, the United States imported $180 billion worth of petroleum products — oil and such.

"According to Ross and Navarro, if the United States made it illegal to import oil, thus wiping $180 billion off the trade deficit, our GDP would rise by $180 billion. With labour constituting 44 percent of GDP, that would mean about $80 billion worth of higher wages for American workers. So why doesn’t Congress take this simple, easy step to boost growth and create jobs?

"Well, because it’s ridiculous.

"What would actually happen is that gasoline would become much more expensive, consumers would need to cut back spending on non-gasoline items, businesses would face a higher cost structure, and the overall economy would slow down with inflation-adjusted incomes falling."

"Trump's Advisers Claim VAT Is A Trade Barrier, Subsidy - Flat Out Untrue, Simply Wrong", Forbes, 26 September, 2016

Tim Worstall

Fellow at the Adam Smith Institute in London

[T]here's one major claim in their paper which is not just iffy, or a bad mistake, nor even wrong, it's simply flat out untrue. This is their claim that a Value Added Tax, a VAT, acts as a barrier against imports and as a booster for exports. The truth is that it does absolutely nothing of the kind. As far as trade is concerned it acts in exactly the same manner as a sale tax - and they aren't saying that the US sales tax is either a barrier to imports or a boost to exports.

Debunking Myths about China that Have Been Played as a Political Gambit

In a nutshell, Trump's argument against China can be summarised as:

America is not only losing jobs to China, as evidenced by the closure of certain American factories and the resultant job losses, but also losing money to China, as evidenced by the US-China trade deficit, and the primary reason for this is that China has been manipulating the value of its currency, i.e. undervaluing it, to make its exports to the US cheaper.

Yet, although this logic can fool economics laymen, it is proven utter nonsense by the experts.

America is not only losing jobs to China, as evidenced by the closure of certain American factories and the resultant job losses, but also losing money to China, as evidenced by the US-China trade deficit, and the primary reason for this is that China has been manipulating the value of its currency, i.e. undervaluing it, to make its exports to the US cheaper.

Yet, although this logic can fool economics laymen, it is proven utter nonsense by the experts.

Myth 1:

"America has lost millions of manufacturing jobs to China."

The Truths:

1. If it has been a shock to many American workers that economic development in China has led to the loss of their jobs, it has been more so to Chinese workers. For example, according to the study of John Giles of Michigan State and Albert Park of the University of Michigan, reported by the Wall Street Journal on 26 October, 2016,

between 1995 and 2002 China's "aggressive restructuring led to the layoffs of 45 million workers, including 36 million from the state sector."

The difference is that the Chinese government has been actively encouraging the Chinese people to learn and embrace change, making possible the rebirth of many millions of workers in the globalised world, while the US government has done little in helping workers affected by globalisation, except bemoaning that American manufacturing sectors have lost jobs to foreign competitors - China in particular - and that it is the latter who is to blame.

2. Given the tide of globalisation since the early 1990s, even if America did not lose these jobs to China, it would have lost them to other countries, such as Mexico, Vietnam, Thailand, Malaysia and Indonesia. Indeed, countries like Vietnam and Thailand are becoming increasingly able to manufacture the same goods at a cost lower than China can.

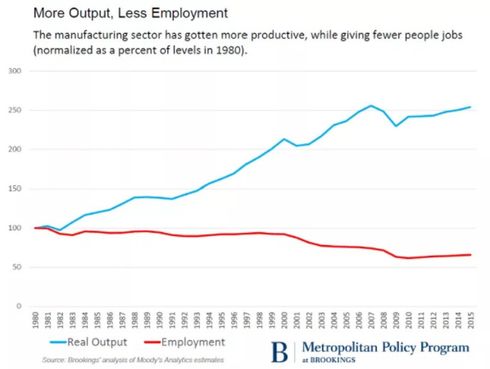

3. As explained by

Scott Lincicome, the U.S. manufacturing sector has been (until the last month or so) setting production (and export!) records, and

almost 90 percent of the decline in U.S. manufacturing jobs between 2000 and 2010 was caused by productivity gains (robots and computers), rather than import competition.

A study by Professor Michael J. Hicks team at Ball State University have also found that“Had we kept 2000-levels of productivity and applied them to 2010-levels of production, we would have required 20.9 million manufacturing workers. Instead, we employed only 12.1 million.” So unless Trump wants to destroy all the robots, those jobs just aren’t coming back, tariff or not!

Myth 2:

"America's trade deficit with China is bad for America."

The Truths:

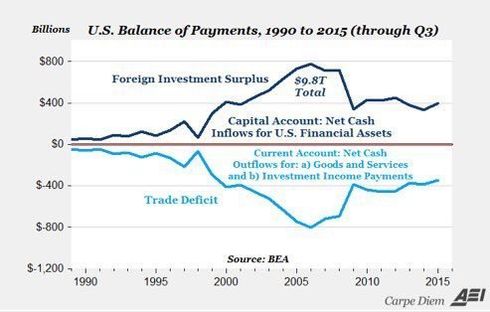

1. The idea that the U.S.-China trade balance proves that we’re “losing” at trade is the height of economic ignorance. For one thing, there’s actually a strong correlation between U.S. economic growth and an expanding U.S. trade deficit. As Cato Institute’s

Dan Griswold wrote:

"An examination of the past 30 years of U.S. economic performance offers no evidence that a rising level of imports or growing trade deficits have negatively affected the U.S. economy. In fact, since 1980, the U.S. economy has grown more than three times faster during periods when the trade deficit was expanding as a share of GDP compared to periods when it was contracting. Stock market appreciation, manufacturing output, and job growth were all significantly more robust during periods of expanding imports and trade deficits."

2. Basic economics teaches us that trade balances reflect national savings, consumption and investment, not trade policy. Thus, every dollar traveling overseas to buy imports (in excess of our exports) eventually comes back to the United States in the form of investment, and our “trade deficit” is matched by a “capital account surplus.” In other words, we buy goods and services from foreigners, and they buy an equal amount of our exports plus our financial assets (also known as foreign investment in the United States).

In this light, the U.S. trade deficit reflects little more than America’s longstanding comparative advantage as a global investment destination. Not so scary, huh?

3. The proliferation of global supply chains and multinational investment has rendered bilateral trade balances an empty trade policy metric. Indeed, old-school trade stats like these have become so obsolete that the World Trade Organization has launched a global initiative to determine how better to account for actual trade flows.

The most common example of the indisputable obsolescence of the U.S.-China trade deficit is the iPhone:

each device imported into the United States from China accounts for about $300 towards the bilateral trade deficit, yet the Chinese get only about six bucks worth of value from the item’s assembly and shipment. Meanwhile, the U.S.-based Apple and its affiliates get hundreds of dollars from an iPhone’s final U.S. sale (for things like design, marketing, and even some manufacturing).

Myth 3:

"China has kept its currency artificially cheap to boost exports."

The Truths:

1. As explained by Professor Matthew J. Slaughter, dean of the Tuck School of Business at Dartmouth College, in his Wall Street Journal article

"The Myths of China's Currency 'Manipulation'", until 2015 China has legitimately pegged its currency to the US dollar, but it exports to many countries beyond the US.

2. On 11 August 2015, when China's central bank decided to leave the value of its currency to the market, it plummeted, meaning that in the past the currency had been overvalued rather than undervalued. The Chinese government has since taken measures to prop up the currency, meaning to make its exports more expensive - if one wants to think that way!

3. As observed by the Brookings Institute:

"The solid line in the chart [below] shows that the yuan has strengthened 35% against the U.S. dollar over the past decade. All else equal, this represents an effective rise in the price of Chinese exports to the United States by more than one-third, which is certainly not consistent with the charge of continued intentional under-pricing."

Perhaps the best way to illustrate how the myth of Chinese currency manipulation has been used by some American politicians as a political gambit is the exchange between Donald Boudreaux, professor of economics at George Mason University, and Senator Lindsey Graham, reported in the American Spectator on 11 January 2016:

Slaughtering the Myth of Chinese Currency Manipulation

"Five or six years ago in the green room of the D.C. satellite of Fox News I met Sen. Lindsey Graham (R-SC). Upon discovering that I once taught economics at Clemson University and had lived in Seneca, SC (where he has a home), he inquired about my opinion of Chinese currency manipulation. No more than ten words of my reply escaped my mouth before it become clear that Sen. Graham was not really interested in my opinion. Instead, he assumed that I shared his notion that the Chinese government manipulates the yuan in order to render that currency unfairly undervalued against the U.S. dollar — and that this undervaluation, in turn, harms the American economy. Upon realising that I regard his notion as economically mistaken, he tuned me out and became noticeably contemptuous of me — me who, I’m sure, he then pegged as an egghead academic who doesn’t understand reality in the crisp, clear, and complete way that he, a politician, understands it.

I pressed on, posing to the politician a number of relevant questions — questions such as “How can Beijing artificially devalue the yuan without such devaluation causing the prices of Chinese exports eventually to rise?”; “Even if Beijing manages for a long time to keep the value of the yuan artificially low, because such an effect will necessarily raise Chinese producers’ costs of purchasing the many inputs that they buy on global markets, why are you so confident that China’s economic growth is fueled by currency devaluation?”; “Even if Beijing manages through currency manipulation to artificially reduce the prices that Americans pay for exports from China, why is that bad, rather than good, for Americans?” The senator answered none of my questions. Fortunately for him — and for me (because I thoroughly dislike being in the presence of all but a tiny handful of politicians) — he was soon whisked away to his TV appearance."

The Trade War Launched by Trump

Trump merely toyed with the idea of reaching a grand bargain with China

Timeline of the US-China trade war so far

- August 18, 2017: At Trump's direction, the U.S. Trade Representative began its "Section 301" investigation into "China's acts, policies, and practices related to technology transfer, intellectual property, and innovation."

- March 1, 2018:

President Donald Trump announces tariffs on all imports of steel and aluminum, including metals from China.

- March 22, 2018:

Trump announces plans to hit $50 billion worth of Chinese goods with a 25% tariff. China announces tariffs in retaliation to the steel and aluminium duties and promises a response to the latest US announcement.

- April 3, 2018:

The US trade representative announces a list of Chinese goods subject to the tariffs. There is a mandatory 60-day comment period for industries to ask for exemptions from the tariffs.

- April 4, 2018: China rolls out a list of more than 100 US goods worth roughly $50 billion that are subject to retaliatory tariffs.

- May 20, 2018: The trade war is "on hold," Mnuchin told "Fox News Sunday." "We have agreed to put the tariffs on hold while we try to execute the framework," he said, following talks between the two sides in Washington.

- May 29, 2018:

The White House announces that the tariffs on $50 billion of Chinese goods will move forward, with the final list of goods released June 15. The move appears to wreck the nascent trade deal.

- June 15, 2018:

Trump rolls out the final list of goods subject to new tariffs. Chinese imports worth $34 billion would be subject to the new 25% tariff as of July 6, with another $16 billion worth of imports subject to the tariff at a later date. China retaliates with an equivalent set of tariffs.

- June 18, 2018:

Trump threatens a 10% tariff on another $200 billion worth of Chinese goods.

- July 6, 2018:

The first tranche of tariffs on $34 billion worth of Chinese goods takes effect; China responds in kind.

- July 10, 2018:

The US releases an initial list of an additional $200 billion worth of Chinese goods that could be subject to a 10% tariff.

- August 1, 2018:

Washington more than doubles the value of its tariff threats against Beijing, announcing plans to increase the size of proposed duties on $200 billion worth of Chinese goods to 25% from 10%.

- August 23, 2018:

After two days of discussions in Washington fail to raise prospects for a deal, the second tranche of tariffs on $16 billion worth of Chinese goods takes effect; China responds in kind.

- September 24, 2008: The US imposed a 10% tariff on a further $200 billion worth of Chinese products, while Beijing has retaliated with a 5% or 10% tariff on $60 billion of US goods. China also accused the US of employing "trade bully-ism practices", "intimidating other countries through economic measures", and hurting the global economy.

Q&A on the US-China trade war

Question:

If the evidence gathered by the US on China's "unfair trade practices" are so convincing, why didn't it take the case to the WTO - after all, both the US and China are members of the WTO?

Answer:

Because the evidence is one-sided: it was gathered as a totally confidential exercise among certain US businesses in China by the US Trade Representative. And to make it difficult for China to defend itself by appealing to the WTO dispute settlement system, the US is currently blocking the appointment of new Members of the WTO dispute settlement body and impeding the functioning of the system.

Question:

On 20 May 2018, the US and China announced that they "are putting the trade war on hold" after talks between the two sides in Washington, but why did Trump press ahead with the trade war?

Answer:

To avoid a trade war that would be bad for both sides and the world at large, China offered concessions by agreeing to "meaningful increases in United States agriculture and energy exports" and "significant" increases in U.S. goods and services overall. However, that process never got very far because Trump wanted war rather than peace - "trade wars are good, and easy to win," according to him.

FOX NEWS: "Columbia professor slams Trump's tariffs on China"

DW NEWS: Jack Ma on China's "theft" of American jobs

Trump's attacks on Amazon and China: The parallels

Amazon: Celebrated story of online business since 1994

Humble beginnings:

Amazon got started out of Jeff Bezos' garage in 1994, employing his wife and another employee. But the servers the company used required so much power that Bezos and his wife could not run a hair dryer or a vacuum in the house without blowing a fuse.

1. Accept occasional failure as the price of innovating.

Bezos: "One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice) and failure and invention are inseparable twins."

2. Work every day like it's your first day in business.

Bezos: "Day two is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death. And that is why it is always Day 1."

3. Give your customers what they want before they know they want it.

Bezos: "Even when they don't know it, customers want something better, and your desire to delight your customers will drive you to invent on their behalf. No customer ever asked Amazon to create the Prime membership program, but it sure turns out they wanted it."

A giant today:

Amazon is the largest Internet retailer in the world, employing over 500.000 workers.

Trump's attacks on Amazon:

1. The US Post Office was losing "billions of dollars" to Amazon.

2. The Postal Service is undercharging Amazon by $1.46 per package.

3. Amazon is taking jobs away from its competitors.

Motives of Trump's attacks on Amazon:

"Transparently political"

1. Amazon is a big corporation.

2. Amazon owner Jeff Bezos also owns the Washington Post, which, like most mainstream media, publishes stories unpalatable to the president.

3. "Friends of Mr Trump in the commercial property sector have also been urging him to protect them from digital retail giants as they see shopping malls closing and rents falling," according to the BBC.

China: Celebrated story of globalised economy since early 1990's

Humble beginnings:

Even after a decade of reform and opening up to the outside world, China was economically backward in the early 1990's. Its GDP per capita then was less than $400, and about 60% of 1.2 billion people lived on less than $1.90 a day, with bicycles jamming the streets.

Three secrets to success:

1. Accept occasional failure as the price of innovating.

At the outset of the reform and opening-up, Chinese leader Deng Xiaoping once said, "cross the river by feeling the stones," which has become the guiding principle for the Chinese people ever since.

2. Work every day like it's your first day in business.

As waves after waves of youngsters from the vast interior joined the workforce, China has been able to keep labour costs in manufacturing comparatively low.

3. Give your customers what they want before they know they want it.

Guided by the age-old Confucian principle of "reciprocity", and without being limited by religious or ideological considerations, the Chinese have been the first people to be able to truly forge trade relations with people from all corners of the world and from all walks of life.

A giant today:

China is the second largest economy in the world, benefiting the world population.

Trump's attacks on China:

1. The US was losing "hundreds of billions of dollars" to China.

2. China is undervaluing its currency by 15% to 40% to make its exports cheaper.

3. China is taking jobs away from American workers.

Motives of Trump's attacks on China:

Transparently political

1. Chinese economy is big.

2. There is no better way to show one's patriotism in a presidential campaign than choose a suitable enemy to beat - China is the most suitable target.

3. Whatever happens with trade wars, Trump is not going to worry that he has to pay more for his food or that he has a mortgage tied to his house. In fact, with all those resources at his disposal, his business empire is set to prosper in the uncertain world.

Who Suffers in the Trade War?

American consumers, manufacturers, and ultimately Trump voters

New York Times

"Trump's Trade Wars - What an American Farmer Thinks"

MSNBC

"Tariffs may eliminate nearly 170 thousand American jobs"

MSNBC

"Trump voters will be hit hardest by Trump’s trade war"

FOX Business

"Trump’s China tariffs are beginning to hit US consumers"

FOX BUSINESS:

Former WTO Appellate Body chairman James Bacchus weighs in on U.S.-China trade war

ASIA BOSS:

What Chinese Think About The US-China Trade War

Case Studies

Bloomberg, 19 Aug, 2018

"Tariffs Will Hurt U.S. More Than Rest of World, Maersk Says"

The U.S. economy will be hit many times harder than the rest of the world by an escalating global trade war, according the chief executive officer of A.P. Moller-Maersk A/S.

Soren Skou, who runs the world’s biggest shipping company from Copenhagen, said the fallout of the current protectionist wave “could easily end up being bigger in the U.S.” Tariffs could slow global annual trade growth by 0.1 to 0.3 percent, though for the U.S. the effect could be “perhaps 3 or 4 percent,” he said at a presentation at Maersk’s headquarters on Friday. “And that would definitely not be good.”

The company transports about 20 percent of the world’s seaborne consumer goods, putting it in a unique position to gauge the fallout of tariffs on trade flows. Maersk has in the past broken with its culture of steering clear of any political debate to criticize the trade policies of U.S. President Donald Trump.

...

“The first thing the American importers would do if tariffs are put on Chinese consumer goods would be to buy in Vietnam, in Indonesia or elsewhere in Asia,” Skou said. “Big U.S. consumer brands like Nike produce in all of Asia, not just in one country, so there will be a substitution effect.”

AFP, 12 Aug, 2018

"Donald Trump's trade beef with China may backfire on meat"

A key objective of President Donald Trump's trade war is to pressure Beijing to "buy American", but when it comes to millions of dollars of US meat imports, China may simply take its business elsewhere.

Beijing's retaliatory tariffs on US pork and beef are making them prohibitively expensive and Chinese importers are simply turning to other sources, a trend expected in other sectors as well.

Shanghai Xinshangshi International Trade Co, a major formerly state-owned Chinese food importer, brought in $40 million worth of US beef and pork in 2017 and had planned to raise that to $100 million this year.

But due to the trade war, its general manager Xu Wei is turning to Europe, Australia and South America instead.

"The gap will be filled very soon," Xu said.

"So for the trade war, if we Chinese importers still want to maintain our trade volumes, it would hurt the US suppliers and exporters the most."

Washington Post, 30 July, 2018

"Layoffs from Trump tariffs are piling up. So are calls for more bailouts."

Jane Hardy, the chief executive of a company that makes lawn-care equipment, says she had to lay off 75 employees this summer because of President Trump’s trade war.

Hardy’s company, Brinly-Hardy, has been in business since 1839. It survived recessions and the Civil War, but it might not survive a prolonged trade war.

Hardy buys steel from U.S. companies, but Trump’s tariffs on foreign steel have caused domestic prices to rise, as well. Steel costs have jumped 33 percent since the start of the year, and Hardy says her costs are up even more.

She was hit again by Trump’s first round of tariffs on Chinese products that went into effect in early July, another hefty cost eating into her bottom line. Other products she imports and says she can’t get domestically are on a list for a second round of tariffs on China likely to go into effect later this summer.

Even larger companies are starting to take a hit or raise prices on consumers, making the impact of the tariffs more visible to Americans across the country. Harley-Davidson is moving some production overseas because of the tariff fight with Europe, Whirlpool blamed losses on the tariffs, and Coca-Cola and Caterpillar say they are raising prices because of higher steel and aluminium costs.

Fortune, 26 June, 2018

"Why Harley-Davidson Is Moving Production Overseas"

The quintessential American brand, Harley-Davidson, is shifting some production overseas to avoid EU regulatory tariffs — but not without some commentary from the President Donald Trump.

Even with President Trump’s disapproval, the Milwaukee-based company views offshore production as “the only sustainable option to make its motorcycles accessible to customers in the EU and maintain a viable business in Europe.”

The Trump administration slapped tariffs on imported steel and aluminum from the EU, Mexico, and Canada, earlier this month. The newly imposed tariffs were designed to protect U.S. jobs, but evoked global anger.

In response to Trump’s tariffs, Europeans are targeting the most iconic American products, such as motorcycles, blue jeans, and bourbon. The EU raised U.S. motorcycle tariffs from 6% to 31%. This percent increase adds nearly $2,200 to the cost of an average motorcycle, according to the public filing.

Such a hike in price “would have an immediate and lasting detrimental impact” to Harley-Davidson’s business in the region, the company says. Instead of raising the manufacturer’s suggested retail price to cover the costs of retaliatory tariffs, Harley will eat the costs itself.